Assess

How are we doing?

Plan

Where are we going?

Structure

Who is doing what?

Execute

Put the plan into action.

Refresh

Measure your progress.

Finding Momentum and Health

"Staff is healthier. We're continuing to make a greater impact. The number of people that we've had come to faith is up over 180%. As a ministry, we're more innovative and creative as missionaries to reach our culture."

Church Consulting

We don't love the term "church consulting" for what we do. (We wouldn't use it if it didn't help pastors find us!) What we really do is help pastors clarify where God's called the church to go in the future, and how you'll get there-and then we coach you as you lead change.

Six months after engaging our team for church consulting, 9 out of 10 pastors recommend us to another church-because they are seeing real results.

The best two days of strategic planning I've ever done

"Clear, helpful and practical, we did what I thought would take us months (create a new vision) in just two days. Impressive."

Carey Nieuwhof

Unstuck is fantastic!

This has been the most helpful consulting partnership we’ve had when it comes to structuring and strategizing for multiplication: clear, concise, and backed up by lots of data and experience. Amy and Tony have been a gift to our team and a catalyst for our future.

Mark Johnston

Getting Started with The Unstuck Group is easy.

Unstuck Learning Hub

In ministry, it can feel like Sunday's always coming. Investing in your own development as a church leader often gets put on the backburner. With the Unstuck Learning Hub, we've made it easy for you to access ministry training and practical tools for church leadership-online and on-demand.

Masterclasses

You get unrestricted access to the archive of every Unstuck Masterclass on a variety ministry leadership topics from top leaders.

Online Courses

Module based, in-depth courses from The Unstuck Group equip pastors with biblical principles and best practices for church leadership.

Digital Resource Library

Download a full library of toolkits and templates you need to put a plan into action, plus The Unstuck Group's eBooks, whitepapers and research reports.

Assessments

Access to our online ministry health assessments, and corresponding coaching calls to help you understand your assessment results and point you towards the best strategic next steps.

Private Facebook Group

Connect with Unstuck Consultants via our subscribers-only Facebook group to ask ministry questions and collaborate with other pastors.

Get started in the Unstuck Learning Hub today and work through the tools at your own pace-just $49/mo.

Free Content

We deliver free, practical tools every week to help you get your church unstuck.

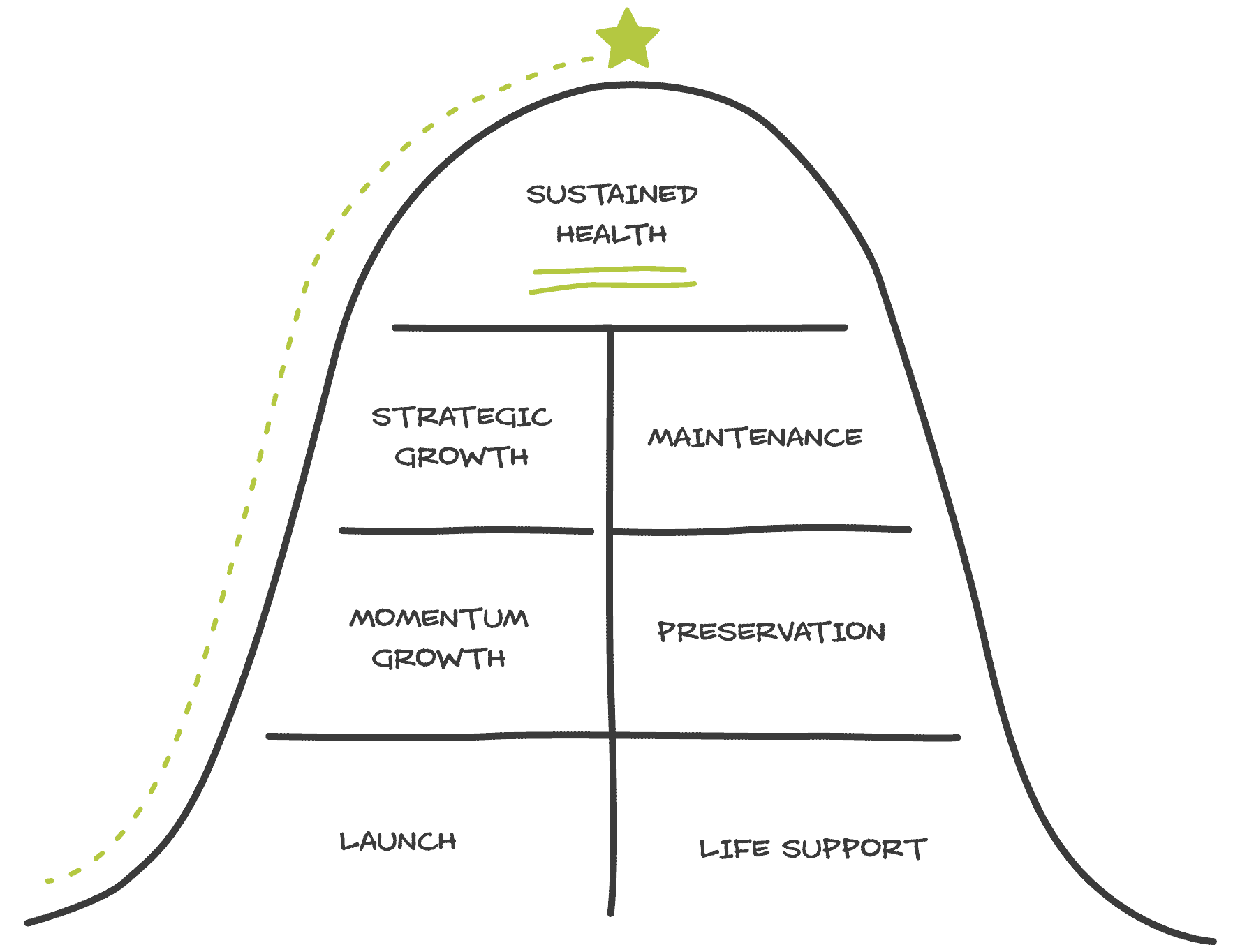

Most organizations start, grow, thrive, lose momentum, decline, and eventually end.

That doesn't have to be your church's story. With The Unstuck Group, you have an experienced ally in your corner helping guide you to build a thriving church.